Publication date: 16 Nov 2018

In the nearest five years, the Russian online advertising market will continue growing (average annual growth of 15%) at a faster pace than the global advertising market (average annual growth of 8.8%). Statistics for 2018 shows that advertisers will spend 22.7% more on digital advertising. Their expenditures will increase by 19.3% in 2019 and by 17% in 2020. This forecast was given by PwC and IAB Russia in their joint research “Russian Market Digital Ad Spend 2017-2020”.

A growth in digital sales revenue tends to slow down in Russia because most of solutions and products are finishing the phase of active growth and entering the phase of maturity when sales volumes continue growing but the growth pace slows down. Now market growth is driven mainly by products that were not available on the market 3-5 years ago.

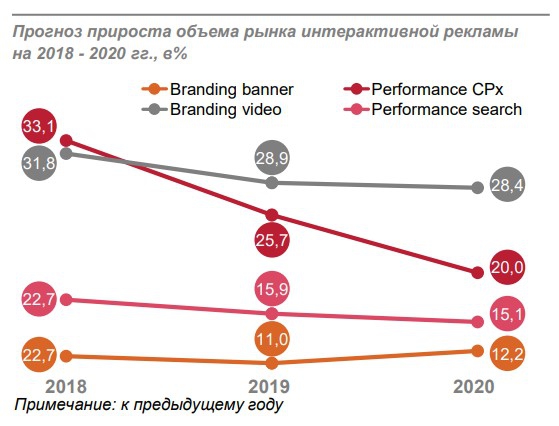

Growth rates in each segment of online advertising

Performance CPx (context ads in social networks, applications and ad networks including MyTarget, Yandex Advertising Network and Google AdSense) will cover the largest part of advertising budget (33.1% growth in 2018). Nevertheless, the growth is expected to slow down from 33.1% in 2018 to 25.5% in 2019 and then to 20.0% in 2020 that brings Performance CPx growth rate closer to the average growth rate of the online advertising market in general.

In 2018, Performance CPx showed this significant growth mainly due to changes that took place during the last two years. New products (native advertising), technologies and analytical tools, including analysis of online and offline data, were introduced.

Branding video will be growing at a faster pace of 31.8%, 28.9%, and 28.4% in 2018, 2019, and 2020, respectively. The growth is driven by the new generation of consumers who are much more into media than their predecessors and got used to consuming content in a different way.

At the same time, the share of the branding banner segment in the digital market is shrinking. It shows the slowest growth of only 11.7% in 2018 as advertisers are shifting their attention from the desktop format to mobile advertising.

A shift to mobile in media consumption

Extensive growth of the Russian online advertising market is closely linked to an increase in internet penetration. GfK has reported a rise in Internet penetration from 70.4% to 72.8% and in mobile internet penetration from 47.0% to 56.0% as of the start of this year.

Penetration rate will continue growing because demand for smartphones is rising and the older generation becomes more involved in internet usage. Among over-55s, the number of internet users increased by a quarter, and the number of mobile internet users rose two times. In the future, this trend will keep getting stronger due to the popularity of social networks, entertainment content, and mobile shopping.

The generation of users is changing. Now the main users are millennials (born between 1981 and 1988) and generation Z (born after 1998); these people have grown up in the web. The way how people consume the content is changing as well. Users got used to “here and now” consumption that certainly contributes to online advertising growth in general and to development of new subsegments, such as video format and voice search.

According to PwC Media Outlook, Russia had 97 million mobile internet subscribers (68% coverage) in 2017. By 2022, this number is forecasted to rise to 177 million (82% coverage).

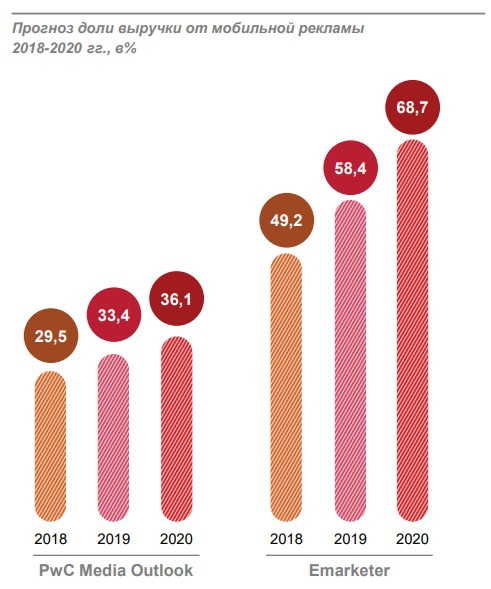

PwC Media Outlook and Emarketer expect mobile share of advertising market to increase rapidly. PwC Media Outlook sees a 3.9% gain by 2019 and 2.7% by 2020. Emarketer, in its turn, expect +9.2% and +10.3%, respectively. Emarketer is more positive in its forecasts regarding not only the growth rate but also how big the mobile share of advertising market will be. Emarketer allocates 68.7% of the market to mobile advertising in 2020, while PwC Outlook Media gives a more conservative estimate of 36.1%.

Growth in mobile advertising will be driven by social networks. According to PwC Media Outlook, about 100 million people use social networks every day. Most often, they do it from their mobile phones: 70% of visits are from mobile devices. The market is gradually starting to consider social networks as true media that requires no less time on content consumption than traditional communication channels.

Advertisers do not allocate budget directly for mobile advertising yet; they buy services both for mobile and desktop audience. A sticking point here is a difficulty with audience measurement in mobile apps.

The goal is transparency in online ad metrics

The absence of unified metrics to analyze digital campaign performance hinders growth of the Russian online advertising market. Efforts of all market participants aimed at finding unified cross-platform performance metrics have a great potential for the market.

Experts note a gradual shift from traditional metrics (e.g., CTR) to attribution system. In the next few years, we will see growing demand for analytics that allows tracking advertising campaigns, from a user’s first visit to a website to the final purchase, and calculating ROI. The way the online advertising market works is now changing as advertisers seek for transparency in all processes. Fraud detection systems, advertising viewability measurement, and transparency in traffic buying lead to a new standard. Systematic and independent analysis of traffic quality has become widespread.

Europe already uses the unified system of certification quite actively. Any advertising platform can gain certification if it wants to use its own metrics; otherwise, it uses basic ones. Europe’s experience shows that the unified system creates prerequisites for a significant increase in advertising spending. Many experts believe that creation and development of a similar system would have a positive impact on the Russian advertising market.

Share it with your friends via favorite social media